In our latest report, Canada’s Housing Supply Shortages, we take a closer look at the gap between supply and demand in the housing system. Our goal is to determine how much additional housing supply is needed to achieve housing affordability by 2030, beyond current trends. Meeting the demand for housing in Canada is critical and increasing supply in the rental and homeownership markets is key to achieving affordability.

This report is an update to our Supply Gaps Estimate report from June 2022.

We maintain our estimate from last year, which indicates a need for 3.5 million more units by 2030 to restore housing affordability. We also present 2 alternative scenarios for consideration: a high-population-growth scenario and a low-economic-growth scenario.

Shifting economic and demographic conditions impact housing demand projections

Changes in economic and demographic projections have impacted our housing demand projections since last year.

- Economic projections have been affected by the ongoing economic slowdown and less optimism around economic growth following the pandemic.

- Demographic projections have been shaped by population movement, including interprovincial migration, during the pandemic, as well as increased immigration.

As a result, there is a decrease in projected housing demand in some areas, such as Ontario, compared to last year. However, we expect housing demand to increase in other provinces, especially Alberta and Quebec because of economic growth.

Supply gap projects vary from province to province

Evolving economic and demographic trends have also led to a shift in the supply gaps between provinces. These gaps represent the difference between anticipated housing supply and the demand for housing if prices were affordable.

Ontario and British Columbia continue to have the largest portion of the 3.5 million housing supply gap — around 60% in our latest projection. These provinces have the least affordable housing markets because housing supply hasn’t kept up with demand over the past 20 years in some of the major urban centres.

Higher projected economic growth in Alberta and Quebec means that the supply gaps in these provinces are higher compared to last year’s estimates.

Quebec, once considered affordable, has become less affordable, indicating the need for more housing supply.

While other provinces still have housing that’s affordable for households with an average disposable income, low-income households still face significant challenges in accessing affordable housing throughout Canada.

Growing labour and material costs impact supply projections

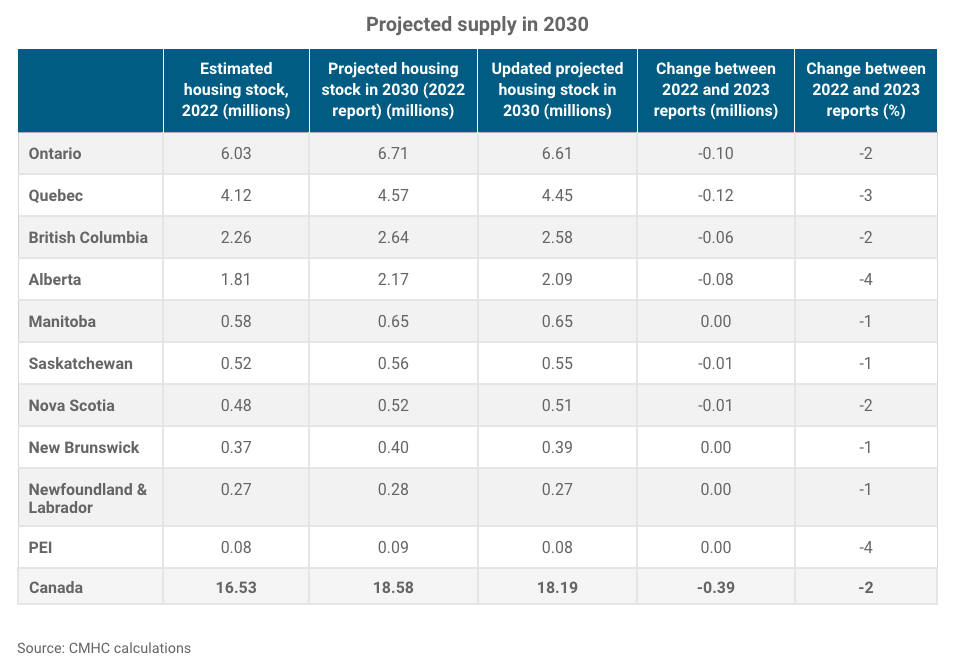

We’ve updated our projections for how much housing supply will be built in Canada by 2030 and the numbers have shifted. Last year we estimated that 18.6 million housing units would be available by 2030. Our updated projection is slightly lower at 18.2 million units. The main reason for this decline is the current shortfall in housing construction.

This means there is a significant gap between the projected supply and the estimated demand. To achieve housing affordability for everyone in Canada, approximately 22 million housing units would be needed by 2030. This includes the 18.6 million that will be available anyway, plus the additional 3.5 million units needed.

Factors contributing to our lower supply estimate include:

- rising labour and material costs

- challenges in securing credit because of rising interest rates and tightened borrowing conditions

What does restoring affordability by 2030 look like?

Like last year’s report, we define affordability based on how much of a household’s income is needed to buy a house. An affordable house requires a small portion of income, while an unaffordable one needs a larger portion. The goal is to make housing costs more affordable, similar to what they were in 2004, before prices surged.

However, achieving this goal won’t completely solve challenges for low-income people and families. To make housing affordable by 2030, the aim is to bring costs back to 2003-04 levels, when the economy was stable and housing costs were lower relative to income.

Exploring alternative scenarios

In addition to our baseline scenario which calls for 3.5 million more units to restore affordability, the report explores 2 alternative scenarios:

- The “high-population-growth” scenario considers what would happen to the supply gap if current immigration levels were extended until 2030. In this case, the supply gap would increase to 4 million housing units.

- A “low-economic-growth” scenario results in a supply gap of 3.1 million more housing units. This scenario is the result of weak economic growth and the current immigration policy ending by 2025.

The housing situation in Canada is changing, influenced by shifts in the economy and population. These changes are affecting demand and supply trends. By considering different scenarios, we can be better prepared to adapt to changes.